Douglas Andersen, State & Local Tax Partner, Brett Johnson, State & Local Tax Principal, Nancy Chher, State & Local Tax Principal,

On December 11, 2020, the Internal Revenue Service issued Notice 2020-78 providing guidance to employers who are claiming Work Opportunity Tax credits (WOTC), allowing employers to retroactively submit certification forms for employees in the Designated Community and Qualified Summer Youth Employee target groups for qualified employees hired since January 1, 2018.

Overview

WOTC provides a federal income tax credit for hiring employees who face barriers to employment out of a dozen targeted groups. Credits range from a maximum of $2,400 to $9,600 per qualified employee, depending on the targeted group.

Two of those targeted groups are Designated Community Resident and Qualified Summer Youth Employee. In both targeted groups, a qualified employee must reside within a federal empowerment zone.

To certify qualified employees, an employer must normally submit Form 8850 (Pre-Screening Notice and Certification Request for the Work Opportunity Credit) for each employee within 28 days of the employee’s start date to a designated local agency that certifies employees for WOTC.

Many employers did not submit Form 8850 for employees in these two targeted groups who were hired after January 1, 2018, because empowerment zones had expired at the end of 2017. The Taxpayer Certainty and Disaster Tax Relief Act of 2019 that was signed into law in December 2019 provided for retroactive extension of empowerment zone designations through December 31, 2020, as well as an extension of WOTC through December 31, 2020.

Rare Retroactive Opportunity to File Form 8850

Employers who hired residents of federal empowerment zones who would qualify for WOTC credits under the Designated Community Resident or Qualified Summer Youth Employee criteria have until January 28, 2021, to submit Form 8850 for employees who began work after January 1, 2018, and before January 1, 2021.

Application

The certification extension allows employers to seek WOTC credits retroactively under these two criteria. It also permits taxpayers whose Form 8850s were denied under these targeted groups to re-submit these forms. The WOTC credit is only for the year in which the employee is initially hired. Unlike the federal empowerment zone credit, qualified employees under the Designated Community Resident” and Qualified Summer Youth Employee criteria are not required to also work within the empowerment zone.

This alert also serves as a reminder that the federal empowerment zone credit has been retroactively extended through December 31, 2020. Employers may receive an empowerment zone credit of up to $3,000 per qualified employee who both lives and works in the empowerment zone. Unlike WOTC, this may be claimed every year that the employee lives and works in the empowerment zone and may also be claimed retroactively for open tax years.

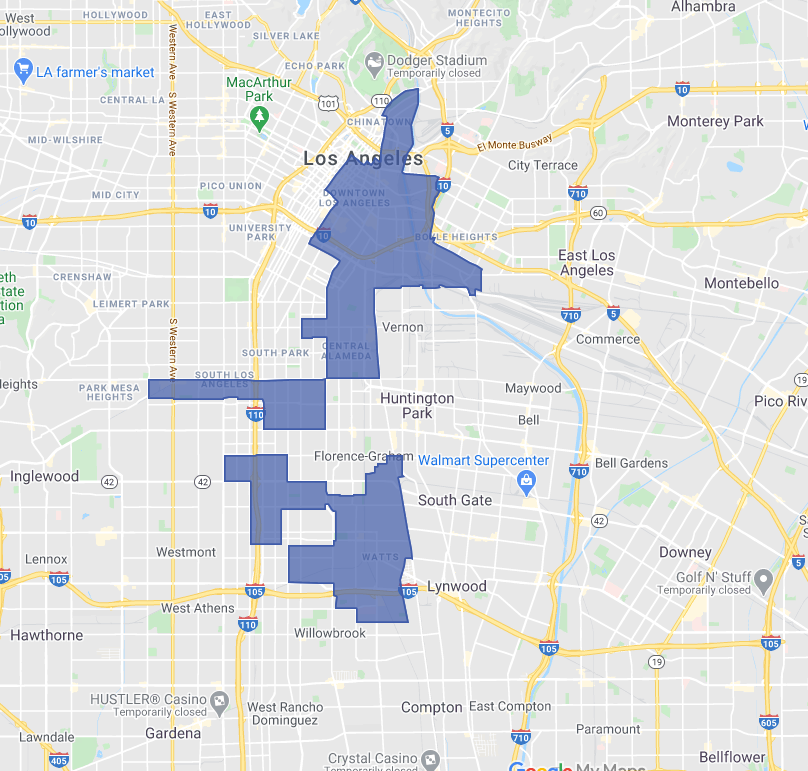

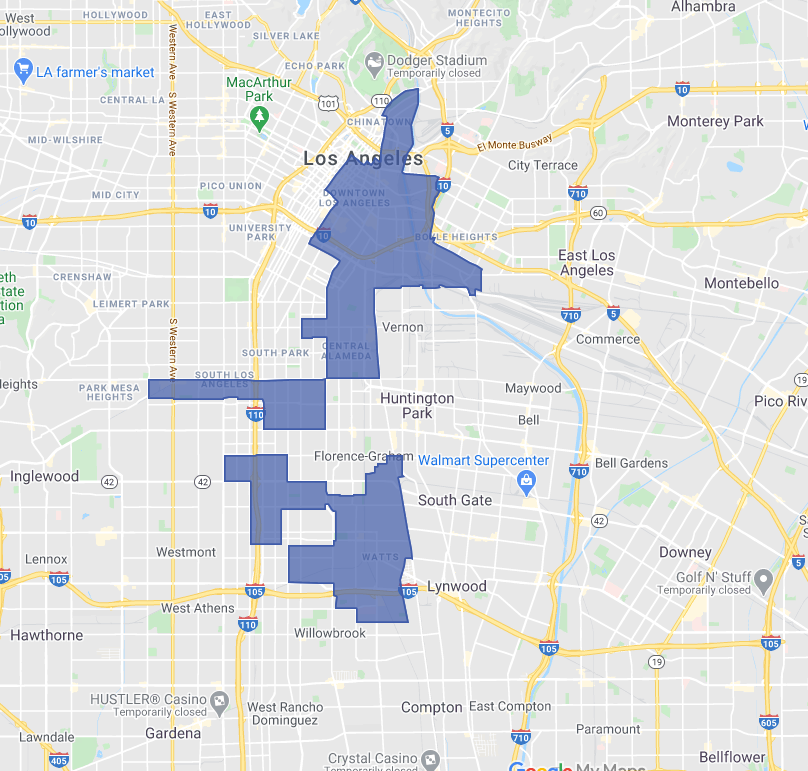

For internal reference, maps of the empowerment zone areas in southern California (Los Angeles, Santa Ana, and Riverside County) are included.

If you believe that the additional time to apply for WOTC certifications or the federal empowerment zone credit may apply to you, please contact one of the following HCVT state and local tax team members to evaluate the opportunity and prepare the necessary forms.

Douglas Andersen | Partner | 562.216.5512 | douglas.andersen@hcvt.com

Brett Johnson | Principal | 310.566.1971 | brett.johnson@hcvt.com

Nancy Chher | Principal | 562.216.1814 | nancy.chher@hcvt.com

Elisa Reyes | Manager | 562.216.5500 | elisa.reyes@hcvt.com

Goran Jovicic | Manager | 562.216.5539 | goran.jovicic@hcvt.com

Los Angeles Empowerment Zone